Happy Sunday,

Here’s a quick roundup of last week’s news :

Chart of the Week #1

In ‘Amazon Pumps the Brakes on Global Domination’ The Information digs into Amazon’s expansion plans:

Chart of the Week #2

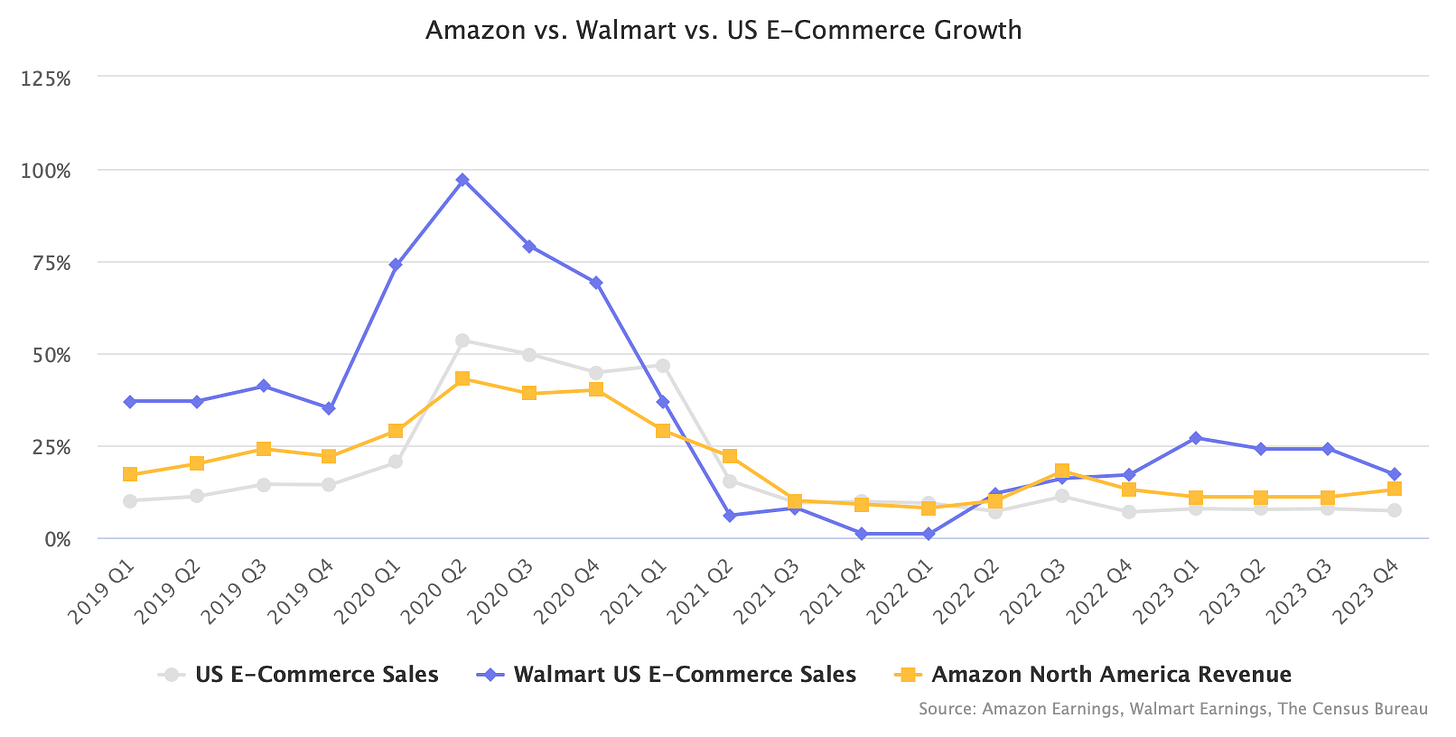

Marketplace Pulse in “eCommerce needs Walmart” highlights eCommerce platform growth, and the role of Walmart in the race of Amazon vs the rest.

Movers & Shakers 🙌

Razor Group acquires Perch and raises $100M at $1.7B valuation [Techcrunch]

Juvo+ acquires Cap Hill Brands and is now Infinite Commerce: $250M in annual GMV across 50 brands [GeekWire]

Win Brands Group had its third round of layoffs in 12 months [Modern Retail]

Strategy 🦈

Amazon loses trademark appeal over 'targeting' UK shoppers [Reuters]

The FTC is probing Amazon’s new controversial fees in its $140 billion seller business [Fortune]

The investor view: “Amazon’s rightsized and regionalized fulfillment strategy set to deliver more profits and more stock gains ahead” [CNBC]

Amazon’s Big Secret [The Atlantic]

Amazon will no longer underwrite loans for sellers in its $140 billion Marketplace business [Fortune]

Amazon's average customer is a white Gen X woman who spent $2,662 there last year [Business Insider]

Oura Ring Launches on Amazon [Business of Fashion]

Temu will open to US merchants soon, and Amazon sellers are eager to try it. Here's why. [Business Insider]

Google and Meta are making billions on Chinese e-retailer Temu’s U.S. push [QZ]

Beyond pays $4.5M to acquire Zulily brand, plans to relaunch flash sale site later this year [GeekWire]

Target to launch its own version of Amazon Prime, starting at $49/year [TechCrunch]

Linktree Jumps Into Social Commerce With Sephora [The Information]

India's Flipkart readies quick-commerce play [TechCrunch]

Myntra secures $54 million fund infusion from parent Flipkart [Economic Times]

JD.com beats quarterly revenue estimates as heavy discounts buoy demand [Reuters]

Events 🎤

ShopTalk, Mar 14-16, Las Vegas, US — ping me if you are around 🫶

Make this week count 🙌

Christian