Happy Sunday,

Here’s a quick roundup of last week’s news :

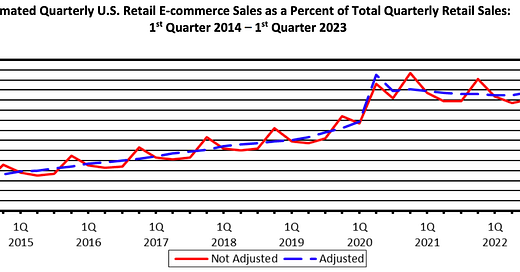

Chart of the week #1 📈

The US Census reported strong Q1 eCommerce growth this week:

3.0% US eCommerce sales increase from Q4-22 to Q1-23

7.8% US eCommerce sales increase from Q1-22 to Q1-23

15.1% eCommerce as a share of total US retail sales

Chart of the week #2 📈

Marketplace Pulse published a comprehensive view of the Amazon Marketplace Tech landscape. Thanks for mentioning Xapix as a leading data analytics provider.

Benchmark of the week 🎯

Powered by Xapix - reach out to us for custom insights for your products.

This week we are looking into the sports & outdoors category:

Want to see where your products can get a conversion rate lift? Compare your sports & outdoors 🏃🏽♀️ product performance (or thousands of other main & subcategories) here.

Funding 💰

Japan: FBA Aggregator Forest announces their $11M Series A [Forest]

Movers & Shakers 💪

India: Thrasio cuts stake, loses control in Indian house of brands in likely market retreat [Techcrunch]

Japan: AnyMind Group agrees to acquire Indonesian e-commerce enabler PT Digital Distribusi Indonesia [AnyMind]

Strategy 📈

Amazon is building an AI-powered ‘conversational experience’ for search [The Verge]

“Optimizing Your ECommerce Presence On Amazon: It’s Trickier Than You’d Think” [Forbes]

“17 Trending Products and Things To Sell Online (2023)” [Shopify]

“Shopify: Finally Accelerating Profitability Through Headless Commerce SaaS” [Seeking Alpha]

eCom revenue up 36.3% to $2.1B in Q1: “Sea Ltd plunges 17% as Q1 earnings miss estimates despite e-commerce strength” [Seeking Alpha]

International commerce up 15% in volume, China commerce down 1% YoY in Q1: “Alibaba Group Announces March Quarter and Full Fiscal Year 2023 Results” [Business Wire]

“Walmart lifts annual sales, profit view on resilient consumer spending” [Yahoo Finance]

“Google to turn off 1% of its cookies in Chrome to test its new ad tech” [Ad Age]

AI-curated Top News 🤖

👋 ChatGPT is back to 📦 The Order

Amazon is increasing its sales fees and commission charges for several product categories, impacting costs for both sellers and consumers. [News18]

Amazon has been overhauling its delivery network to dispatch packages faster and at lower costs. This logistic makeover has resulted in shorter delivery times, transformed inventory management, and altered the search results customers see on its website. The company is now focusing on prioritizing inventory near customers. The products that customers see when they search online will be different; items that are already located within a customer’s region might appear higher on results because they can get to customers faster. The company has reported a 15% reduction in the distance items travel from fulfillment centers to consumers and a 12%+ decrease in how often a package is handled. However, some merchants that sell on the website are still seeing some delivery delays, the causes of which can be difficult to pinpoint. [Wall Street Journal]

A new law, the INFORM Consumers Act, is set to take effect on June 27, requiring Amazon to “collect, verify, and disclose” information about high-volume third-party sellers. Amazon already verifies sellers’ business information during and after registration, but the new law requires additional steps to verify information related to high-volume sellers. The company will contact sellers if they need to take further action and has recommended that sellers check their account information to ensure that it is accurate and current. [eCommerce Bytes]

Events 🎤

European Seller Conference, June 8-9, Prague, Czech Republic

World Ecommerce Forum, June 8-10, Istanbul, Turkey

Amazon Selling Partner API DevSummit, July 25-26, Seattle, US

Make this week count 🙌

Christian