Happy Sunday,

Here’s a quick roundup of last week’s news:

Chart of the Week:

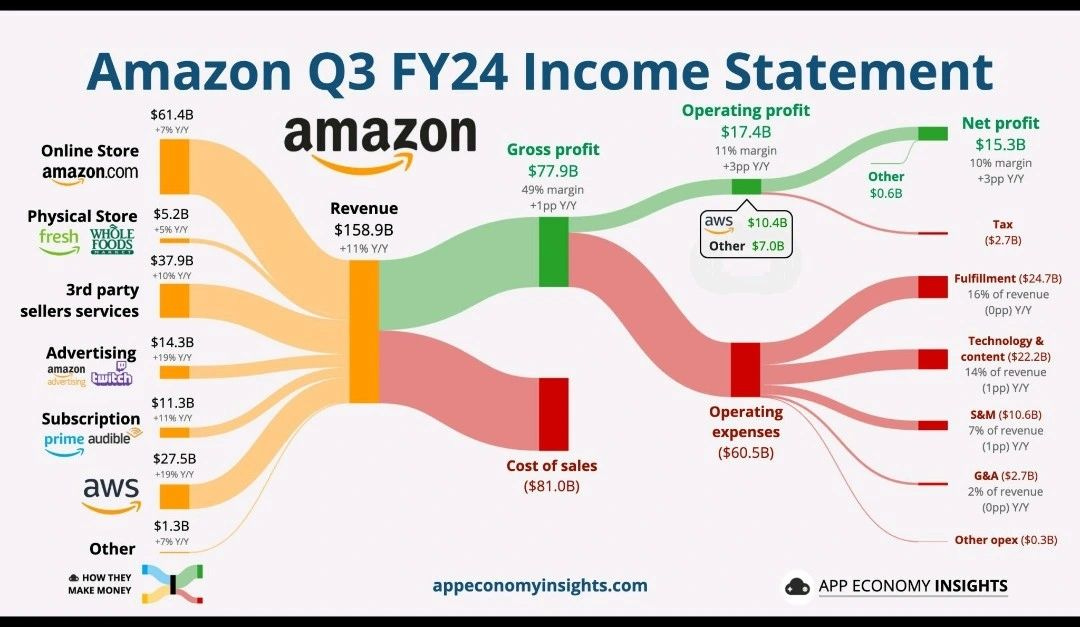

Amazon’s impressive growth continues — Q3 at a glance:

3rd Party Seller Services: $39.7B (+10% YoY)

Ads: $14.3B (+19% YoY)

Online Store: $61.4B (+7% YoY)

Subscription: $11.3B (+11% YoY)

AWS: $27.5B (+19% YoY)

Full details here.

Movers & Shakers 🙌

The next wave: Nexxus Capital Acquires Assets of Top Amazon Aggregator, Intrinsic Brands [PR Newswire]

Meesho claims Indian e-commerce first with positive cash flow [TechCrunch]

Amazon Invests in Spotter, Which Has Paid Out More Than $940 Million to Creators [Variety]

Viably Announces Strategic Acquisition of BeProfit to Enhance Ecommerce Banking Solution [EIN Presswire]

Mounting creditor pressure at Olsam [Stifted]

Go North restructuring [Wall Street Journal]

Strategy ♟

Amazon Projects Strong Holiday Season Revenue and Profit [Bloomberg]

The Oprah Boost: “Oprah’s Favorite Things 2024: 10 unique small businesses to shop for holiday gifts in Amazon’s store” [Amazon]

Amazon Plans to Pair Black Friday Games From NBA, NFL [Variety]

The Amazon Everyone Should Have Feared [Marketplace Pulse]

Amazon shows seller ratings on product search results in new test [Geekwire]

Amazon Shares Rise on Robust Demand, Surge in AI Infrastructure Spending [Wall Street Journal]

Amazon’s latest actions against fake review brokers: Amazon and Google file parallel lawsuits against a fake review website [Amazon]

Brands are preparing their ad strategies for a week of post-election uncertainty [Modern Retail]

Research Briefing: Brands bet on gift guides, haul videos to inspire holiday gifting [Glossy]

Shopify Is Winning Salesforce Clients, Stoking E-Commerce Rivalry [Yahoo]

EBay Falls After Projecting Lackluster Holiday Season Sales [Bloomberg]

LVMH's third-quarter revenue declines as consumers more cautious [Insider Retail]

Events 🎤

National Retail Federation NRF 2025, Jan 11-14 in New York

Make this week count 🙌

Christian