The Order : Weekly Aggregator Roundup - Grove

Chart of the week

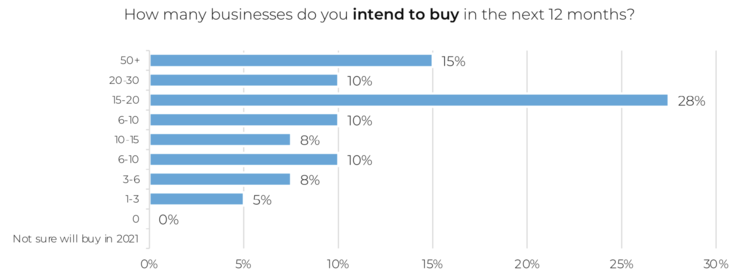

Business Insider headlined this week: "Amazon sellers will be acquired at an unprecedented rate next year, according to a new survey. Many buyers say they will pay anything for these businesses." In the article the outlet publishes Fortunet survey stats across 42 aggregators.

1000 acquisitions are planned for the next 12 months:

With 61% of buyers preferring a full acquisition, deal terms are structured as follows:

New funding this week: $0M

Funding Craze 💰

While no major funding rounds were announced this week, this piece of news will still yield stronger seller-acquisition activity:

This CBD & wellness company plans to add 10+ Amazon brands next year: "Grove Launches New Division to Compete With Amazon Aggregators" [PYMNTS]

Strategy 📈

Thrasio and other Amazon aggregators are expected to make over 7,000 hires this year after raising a collective $7.2 billion. Here's who they're looking to hire as the space gets increasingly competitive. [Business Insider]

Strategic options around fulfillment & mutlichannel operations: The Future for Marketplace Aggregators [Multichannel Merchant]

Fueling the regulation debate - systematic knockoff creations & search manipulation in India: "Amazon copied products and rigged search results to promote its own brands, documents show" [Reuters]

Marketplaces in the US are split on new regulation: "Amazon's e-commerce bill bind" [Axios]

Easier ERP integrations in the Shopify space with direct ability for merchants to connect their ERP solutions for NetSuite, Infor, Acumatica and Brightpearl, and Microsoft Dynamics 365 (early 2022) to their Shopify stores: "Shopify launches global ERP program" [PYMNTS]

Events 🎤

Webinar on Aggregator Investment Trends by Fortia Group Oct 19 4pm UK | 11am EST [Fortia Group RSVP]

Let's make this week count,

Christian